This case has been decided! See how it turned out.

Marinello avoided paying corporate and personal taxes for years. He routinely destroyed his business records and used corporate income for personal expenses.

Marinello was convicted of a felony tax provision that he argues does not apply to his case. To address the argument, the Justices must decide how to account for the history of the provision.

In this case, the Justices will evaluate a tax law. The provision at issue makes it a felony to corruptly obstruct the administration of the tax code (paraphrasing 26 U.S.C. § 7212(a)).

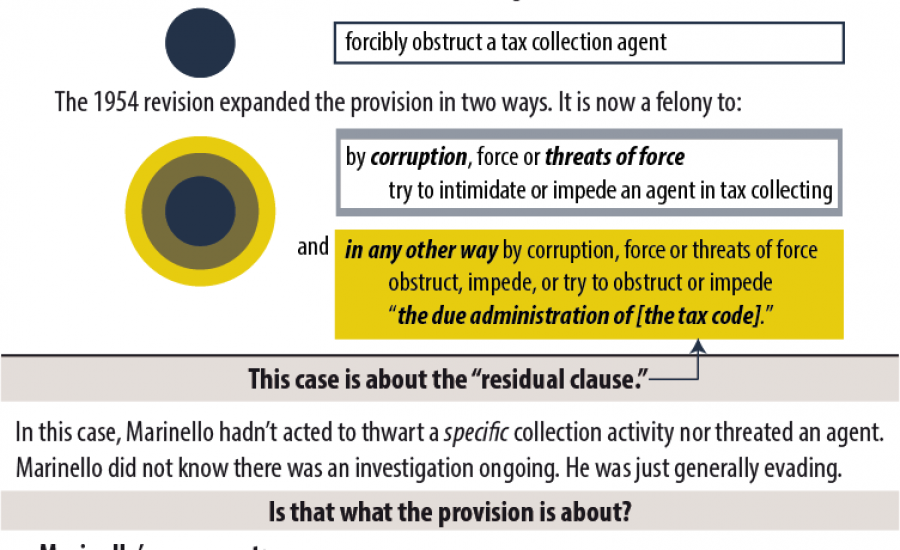

The provision first appeared in a tax law in 1864. It imposed penalties for people who forcibly obstructed tax collection agents – yes, a physical interaction. As the times changed, we became less tolerant of even threats of intimidation.

The provision first appeared in a tax law in 1864. It imposed penalties for people who forcibly obstructed tax collection agents – yes, a physical interaction. As the times changed, we became less tolerant of even threats of intimidation.

In 1954, the provision was expanded. It is now a felony to threaten an agent who is collecting tax, or to try to intimidate the agent. Along with that expansion came a “residual clause.” That clause is the one the Court will address in this case.

Marinello was convicted of the residual clause, but he was not trying to intimidate a tax collection agent; he wasn’t acting to obstruct a particular collection activity against him. He was just generally evading his tax obligations for years.

It looks like the flagrance of his actions left him with this felony charge. And now he’s arguing that the “residual clause” isn’t meant for his situation. He didn’t even know there were any collections activities going on.

The United States disagrees, saying Marinello may as well have known there would be a collection action against him – doesn’t everyone know you have to pay your taxes?

This case will determine if the residual clause should be interpreted more narrowly than the United States wants to use it here.